Amherst CARES

Strengthening Our Residents’ Foundations

Empowering Communities Through CARES: A Model of Innovation and Strength

Our residents are our top priority. Amherst and Main Street Renewal have worked for over a decade with families that have outgrown apartment living, have limited purchasing power, and are looking for a spacious home. We listen to these families and understand how their housing choices have been limited by structural barriers to mortgage credit and lack of single-family housing supply. Amherst is proud to expand the choice of housing options available to our residents and provide wrap-around services to help them thrive.

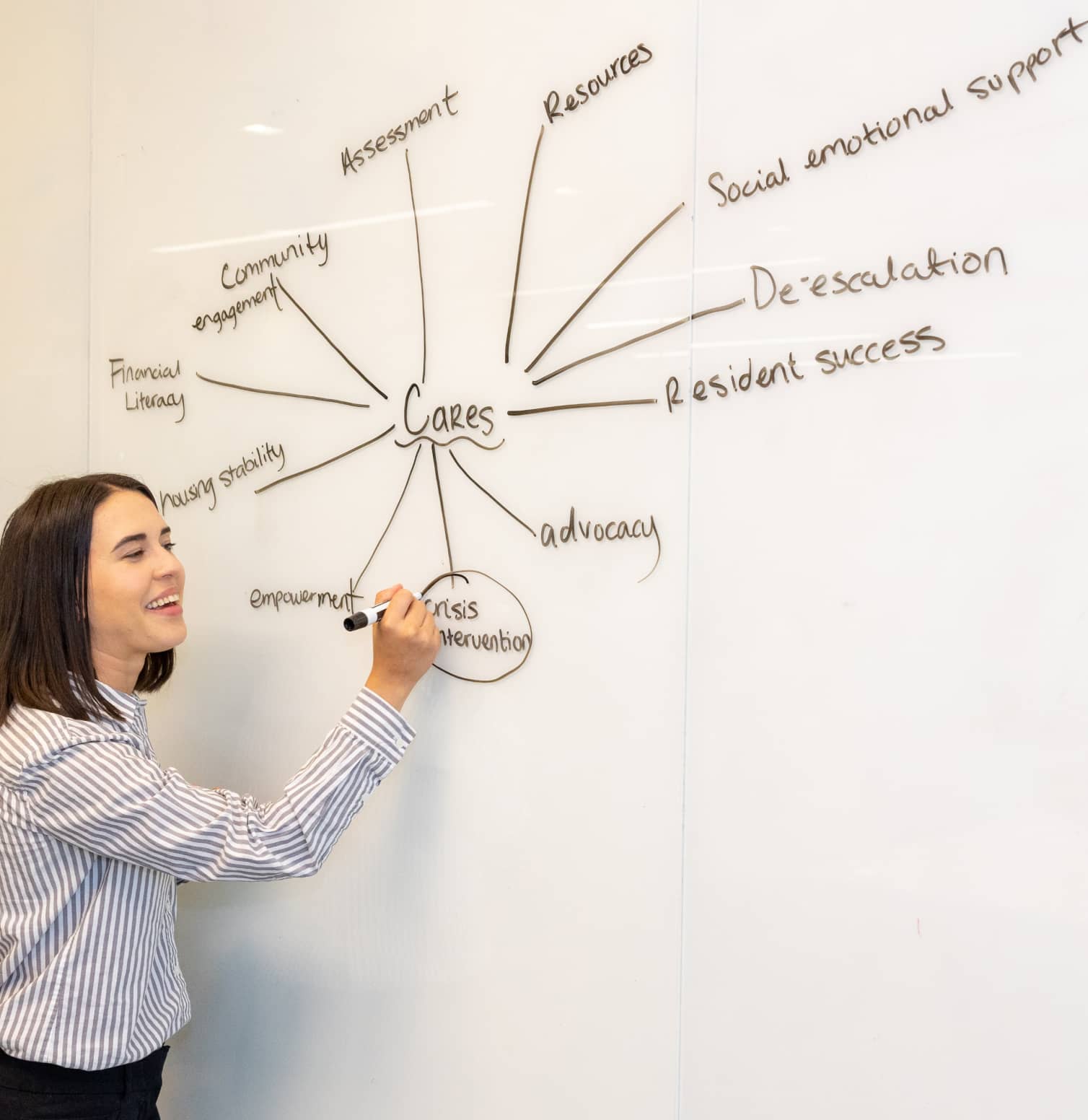

Launched in 2017, the CARES (Client Assessment Resources and Empowerment Services) program is a groundbreaking initiative that helps our residents thrive. CARES is designed to educate and empower residents, fostering housing stability through resource sharing, advocacy, and emotional support.

CARES by the numbers*

Total number of residents served[1]

Of residents enrolled

successfully graduated from

their personal programs

Residents registered for CARES case management services

*Data as of 2024

The CARES team is foundational for our residents.

Connect them with essential resources

Provide social-emotional support during challenging times

Personalize case management services to address current needs

Plan for the future with confidence

How CARES Makes a Difference

In moments of crisis, the CARES team ensures timely, effective support by connecting residents to local resources and working closely with property management teams to help residents regain stability and move forward.

The success of the CARES program lies in its commitment to personalized, consistent support. By meeting residents where they are and equipping them with tools for self-advocacy, CARES fosters resilience, promotes self-sufficiency, and empowers individuals to build brighter futures.

Through evidence-based approaches, CARES reduces housing challenges and default rates while strengthening social welfare and community ties. CARES serves as a model for how innovative programs can create meaningful, lasting change.

In 2024, CARES introduced a proprietary Housing Stability Index that evaluates multiple factors — from income loss and domestic violence to food access and mental health.

This tool enables CARES specialists to build highly tailored plans and consistent support to meet residents where they are.

- Equips residents with tools for self-advocacy

- Fosters resilience

- Promotes self-sufficiency

- Empowers individuals to build brighter futures

Launched in 2024, the CARES Housing Counseling program provides personalized guidance to help residents achieve greater financial stability.

Led by a certified financial social worker, participants receive focused support to:

- Manage expenses and cash flow

- Build credit

- Boost savings

- Set realistic financial goals based on their needs.

Through practical education, one-on-one coaching, and accessible tools, CARES Housing Counseling empowers residents to develop the skills and confidence needed to overcome financial challenges, while working toward long-term financial wellness.

Our CARES team provides resource awareness to our residents in need and plays an integral role in facilitating applications for Emergency Rental Assistance Programs (ERAP). By actively monitoring local programs and alerting residents facing hardship about ERAP resources, the CARES team has helped thousands of residents in need.

In 2024 alone:

ERAP applications facilitated

Average rental assistance payment

ERAP dollars secured for residents

Residents received rental assistance

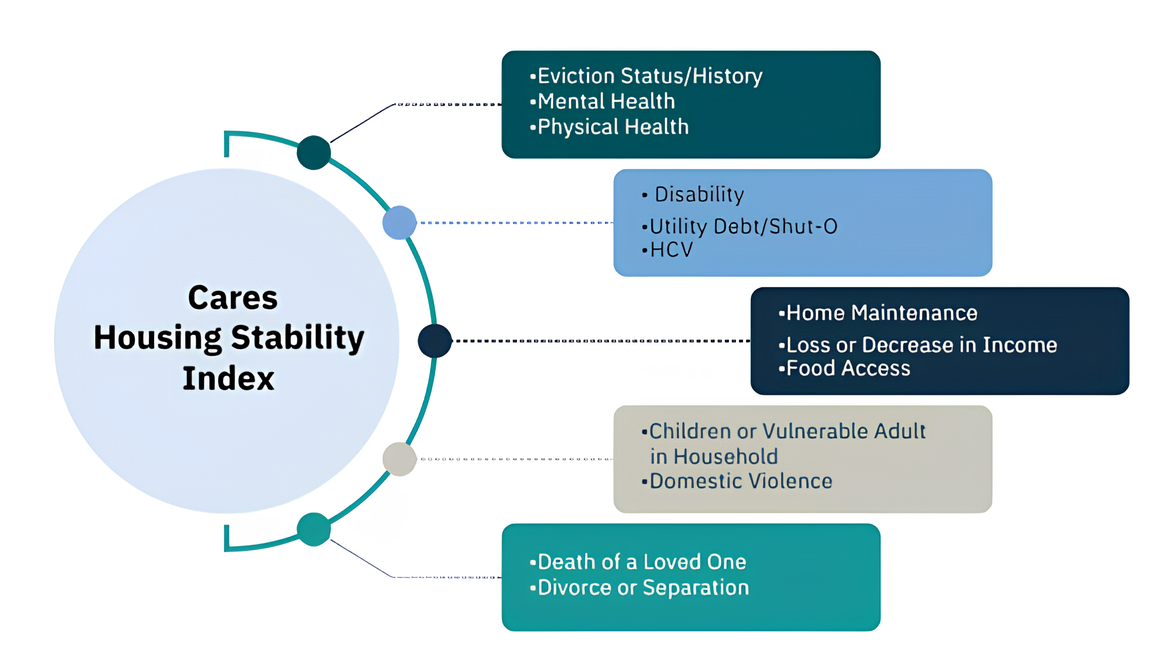

Housing Stability Index

In 2024, CARES introduced a proprietary Housing Stability Index that evaluates multiple factors — from income loss and domestic violence to food access and mental health.

This tool enables CARES specialists to build highly tailored plans and consistent support to meet residents where they are.

- Equips residents with tools for self-advocacy

- Fosters resilience

- Promotes self-sufficiency

- Empowers individuals to build brighter futures

Housing Counseling Program

Launched in 2024, the CARES Housing Counseling program provides personalized guidance to help residents achieve greater financial stability.

Led by a certified financial social worker, participants receive focused support to:

- Manage expenses and cash flow

- Build credit

- Boost savings

- Set realistic financial goals based on their needs.

Through practical education, one-on-one coaching, and accessible tools, CARES Housing Counseling empowers residents to develop the skills and confidence needed to overcome financial challenges, while working toward long-term financial wellness.

Emergency Rental Assistance

Our CARES team provides resource awareness to our residents in need and plays an integral role in facilitating applications for Emergency Rental Assistance Programs (ERAP). By actively monitoring local programs and alerting residents facing hardship about ERAP resources, the CARES team has helped thousands of residents in need.

In 2024 alone:

+ ERAP applications facilitated

average rental assistance payment

+ ERAP dollars secured for residents

+ residents received rental assistance

Supporting Residents and Building Futures

Through evidence-based approaches, CARES reduces housing challenges and default rates while strengthening social welfare and community ties. CARES serves as a model for how innovative programs can create meaningful, lasting change.

[1]Includes roll-over residents from 2023

[2]Testimonials appearing in this report are received in various forms via a variety of submission methods. Testimonials reflect the real-life experiences of individuals who used our products and/or services. However, individual results may vary. We do not claim, nor should the reader assume, that any individual experience recounted is typical or representative of what any other consumer might experience. Testimonials are not necessarily representative of what anyone else using our products and/or services may experience. The people giving testimonials in this report may have been compensated for use of their experience.